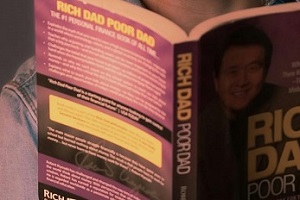

Rich Dad Poor Dad – the inspiration

Rich Dad Poor Dad by Robert Kiyosaki is a transformative book that has inspired millions worldwide to rethink their approach to money and investing. The book tells the story of Kiyosaki’s two “dads”—his own father, whom he refers to as his “poor dad,” and the father of his best friend, his “rich dad.”

Through the contrasting money philosophies of his two father figures, Kiyosaki explores financial literacy, the importance of building assets over liabilities, and the fundamentals of entrepreneurship. This classic personal finance book has changed how people perceive wealth-building and has spurred countless readers to pursue financial freedom.

If you enjoyed Rich Dad Poor Dad, here are 5 more similar books that offer valuable insights on wealth creation, investing, and financial independence.

-

The Millionaire Next Door – by Thomas J. Stanley and William D. Danko

The Millionaire Next Door provides a deep dive into the habits and lifestyles of self-made millionaires in America.

Stanley and Danko challenge stereotypes, revealing that true millionaires are often frugal, resourceful, and disciplined individuals living below their means. They stress that wealth isn’t necessarily about flashy lifestyles but about diligent saving and smart investment choices. The book categorizes people into two groups: “Under Accumulators of Wealth” (UAWs) and “Prodigious Accumulators of Wealth” (PAWs), analyzing their behavioral differences to emphasize why some people succeed financially while others do not.

Stanley and Danko’s research-backed insights highlight seven key traits of financially successful people, such as financial independence, budgeting, and taking calculated risks. Readers of Rich Dad Poor Dad will appreciate The Millionaire Next Door’s practical perspective on building and preserving wealth, focusing less on income level and more on disciplined wealth accumulation.

-

Think and Grow Rich – by Napoleon Hill

A classic in the self-help genre, Think and Grow Rich by Napoleon Hill emphasizes the mental and psychological attitudes necessary to achieve wealth and success.

Originally published in 1937, the book was inspired by Hill’s interviews with some of the wealthiest men of his time, including Andrew Carnegie and Thomas Edison. Hill’s principles revolve around visualization, goal-setting, and harnessing the power of positive thought. One of the book’s key ideas is the “Mastermind Group”—a group of like-minded individuals who support each other’s goals and aspirations.

Hill also discusses how the subconscious mind and “burning desire” drive financial success. Think and Grow Rich resonates with Rich Dad Poor Dad readers because of its emphasis on mental discipline, self-belief, and proactive action, all of which are essential for achieving financial freedom. Hill’s timeless advice continues to inspire individuals looking to transform their mindset and achieve extraordinary results.

-

The Richest Man in Babylon – by George S. Clason

The Richest Man in Babylon offers age-old wisdom on financial management through a series of parables set in ancient Babylon.

George S. Clason uses the story of Arkad, a poor scribe who becomes the richest man in Babylon, to illustrate principles like saving a portion of one’s income, investing wisely, and protecting assets. The book’s “Seven Cures for a Lean Purse” and “Five Laws of Gold” are simple yet powerful guidelines that help readers understand the importance of disciplined money management. Clason’s storytelling approach makes financial concepts accessible and engaging, teaching readers to live below their means and make prudent financial choices.

For Rich Dad Poor Dad fans, The Richest Man in Babylon offers a similarly practical, timeless perspective on building and maintaining wealth. By combining timeless financial wisdom with memorable parables, Clason’s book provides actionable steps for anyone on the path to financial independence.

-

The Total Money Makeover – by Dave Ramsey

Dave Ramsey’s The Total Money Makeover is a no-nonsense guide to taking control of your finances, eliminating debt, and building wealth.

Known for his “Baby Steps” approach, Ramsey offers a seven-step plan for achieving financial stability, starting with saving a small emergency fund, paying off debts, and ultimately building long-term wealth through investments. Ramsey emphasizes the dangers of debt, urging readers to adopt a cash-only lifestyle and live within their means.

With real-life success stories and clear, actionable advice, Ramsey’s philosophy aligns well with Rich Dad Poor Dad’s emphasis on financial discipline and avoiding liabilities. The Total Money Makeover is ideal for readers seeking a structured, step-by-step plan to get out of debt and achieve financial security.

Ramsey’s straightforward, motivational style provides an inspiring framework that resonates with those looking to make meaningful, lasting changes in their financial lives.

-

Your Money or Your Life – by Vicki Robin and Joe Dominguez

Your Money or Your Life is a groundbreaking book that challenges readers to rethink their relationship with money and work.

Vicki Robin and Joe Dominguez outline a nine-step program that guides readers in examining their spending habits, understanding their “real” hourly wage, and transforming their approach to money as a tool for freedom, rather than simply for consumption. The book’s central message is that financial independence comes not only from earning more but also from aligning spending with personal values. Robin and Dominguez also introduce the concept of “enough,” teaching readers how to define their own level of financial contentment.

For fans of Rich Dad Poor Dad, this book is particularly compelling because it provides a holistic perspective on financial independence, emphasizing fulfillment and freedom as the ultimate financial goals. Your Money or Your Life is ideal for anyone seeking a more purposeful approach to money management and wealth-building.

Which one’s the best🎯

Each of these books offers a unique take on wealth-building, self-discipline, and financial independence, providing readers with different approaches to achieving financial success.

Of these titles, Think and Grow Rich has remained one of the best-sellers and continues to be widely regarded in 2024 as an essential read for those pursuing financial and personal growth. Its universal principles on mindset, self-belief, and goal-setting have made it a timeless favorite in the realm of wealth and self-help literature.